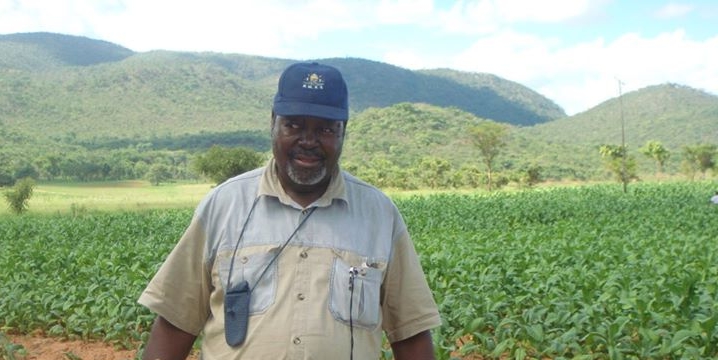

Paul Mukondo

by Tapfuma Machakaire

Attempting to persuade someone to buy a life insurance policy in present day Zimbabwe is like flogging a dead horse. But those who grew up in the late sixties to the mid-eighties will differ, for how could a person live without one or even two life policies? They are likely to ask.

Back then, in a fairly stable economy, there were men and women who were committed to ensure that almost every productive citizen was insured. The name Paul Mukondo quickly springs to mind as one who went the extra mile to “propose” clients.

Hupenyu Hwenyu Idambudziko Remwoyo wangu,is a statement in the Shona language which translate to your wellbeing is my concern. It became the famous insurance marketing phrase coined by Paul Mukondo who was a prominent insurance personality of the 1970s’s into the 1980’s.

Mukondo was such a cunning insurance broker who demystified insurance with a series of catchy phrases in the local language in his weekly radio programme Mari Nehupenyu Hwevanhu (money and people’s lives).

The programme ran from 1970 to 1989 on the African Service of the Rhodesia Broadcasting Services, which changed to Radio 2 after the attainment of independence in 1980 and later to the current Radio Zimbabwe. The commercial would be spiced with a jingle, Hama itai cent cent,inini ndachona, Kana usina mari hauna shamwari (Please contribute a penny each, I am broke, if you don’t have money you don’t have friends).

Each programme would kick off with a punchy introduction with an echo sound effect introducing the presenter Mukondo, with the salutation Baba (father), reminding the audience to prepare to listen to words of wisdom from a fatherly figure.

This would be followed by the deep sombre and authoritative voice of Paul Mukondo greeting everyone and getting to his usual opening sentence Hama dzangu ndinogara ndichikutaurirayi kuti…… (My friends, I always tell you this….) and the story of the day would flow.

In each edition of the programme, Mukondo would narrate a differentshort story meticulously selected to target a particular audience, be it in the mining, agriculture, farming industry, retail business and even civil servants. The man had a recipe for everyone with each presentation leaving individual listeners to introspect over their personal, family and property security with and or without an insurance policy.

Mukondo would normally have a partner in the studio,sufficiently schooled to seek clarity on particular issues, thus, effectively representing listeners who would have had similar queries.

The stories would always have a happy beginning and a sad ending with the main character regretting not having signed up an insurance policy, which would have been the only cushion against their predicament that Baba VaMukondo would have presented.

Through his famous Sunday morning infomercials for Southhampton Insurance Brokers, Mukondo convinced people that life and property insurance policies were an absolute necessity at a time when the majority black Zimbabweans considered insurance as a privilege.

On radio, Baba Mukondo’s voice would have that compassionate but authoritative tone and he would always use terms like hama dzangu referring to listeners as my relatives and that would keep the audience attentive, persuaded to listen to the “sympathetic” Mukondo, each time he was on air.

Southampton Insurance Brokers became the insurance company of the time as many working class citizens felt compelled to sign up for insurance.

In a report of May 26, 2017 in the Zimbabwe Independent, journalist Nhamo Kwaramba argued that entrepreneurship thinking, focus and actioning needed to be nurtured, promoted and supported. He wrote that the absence of an extensively communicated entreprenuerial policy had resulted in less people venturing into new innovations and creations. He stated that very few people knew about entreprenuers like Roger Boka, Paul Mukondo, Strive Masiyiwa, Shingai Mutasa, Lovemore Mukono, Mutumwa Mawere, Sam Levy, Trevor Ncube, Shingi Munyeza and others.

In 1999 the late Samuel Chimusoro published the book Nothing is Impossible a biographical novel based on the life of Zimbabwe’s earliest and successful insurance agent, Paul Mukondo.

The main character, Paul Mukondo under the pseudo name Simbai, is wise enough to listen to advice, as a result, Simbai excels in his studies, ventures into business later joining the insurance industry and was to be admitted as a member of the Million Dollar Round Table.

At the time of his death in May 2013 at the age of 68, Paul Mukondo was the owner of PMA Real Estate, Paul Mukondo Insurance Brokers and Paul Mukondo Life Assurance. He was also the vice president of the Real Estate Council of Zimbabwe and the chairman of Danhiko project whose Patron was the then First then First lady Amai Grace Mugabe.

Those who were privileged to follow Paul Mukondo’s commercials on radio will tell you that 19 years after Mukondo’s death, few if any commercials have reached the standard of the highly creative commercial Mari Nehupeyu Hwevanhu. And even with the added advantage of visuals, television commercials in Zimbabwe today may still be a far cry from the level set by the likes of Baba vaMukondo.